Gold price falls for the fifth straight month on rising dollar over expectations for further raise of interest rates

Spot gold price fell to the lowest level in two months on Wednesday, weighed by strengthening dollar on expectations for more rate hikes in fight with soaring inflation.

The yellow metal holds firmly in red for the third consecutive week and is on track for the fifth straight month of losses, down almost 12% since April.

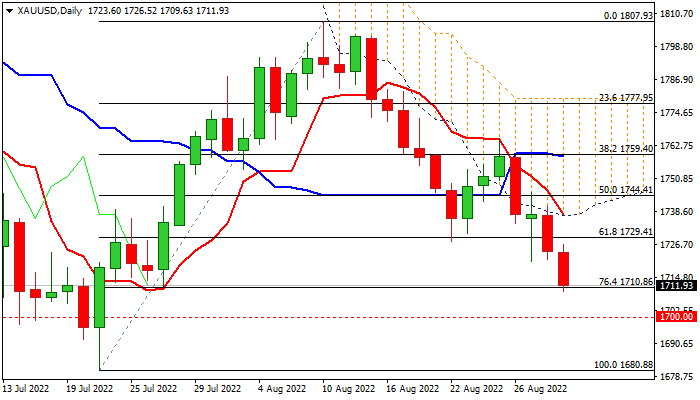

Fresh weakness cracked pivotal Fibo support at $1710 (76.4% of $1680/$1807 rally), exposing psychological $1700 level and key support at $1680 (2022 low, the lowest since Mar 2021).

Fundamentals remain negative for the metal, while bearish technical studies add to weak structure, however oversold conditions may slow bears for consolidation, as bids were seen on $1710 and also expected at $1700 zone.

Upticks should offer better selling opportunities in dominantly bearish environment, with the base of thick daily cloud $1737), reinforced by falling daily Tenkan-sen, marking solid resistance which should limit correction and keep bears intact.

Res: 1720; 1726; 1729; 1737

Sup: 1700; 1697; 1680; 1650