Gold remains constructive though still looking for clearer direction signal

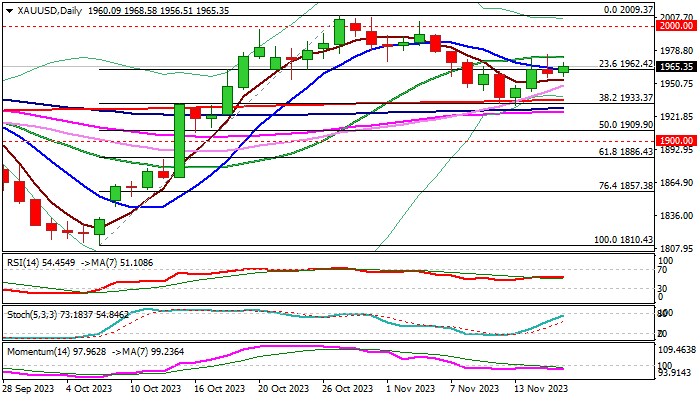

Gold regained traction on Thursday after three-day recovery was strongly rejected on Wednesday, remaining biased higher, although still capped under pivotal barriers at $1970/73 (50% retracement of $2009/$1931 / 20DMA).

Wednesday’s bearish candle with long upper shadow warns about recovery stall and the downside will remain vulnerable (on threats of bull-trap) as long as $1970/73 resistances cap, as momentum remains negative on daily chart.

Gold benefited from fresh signals that Fed’s tightening cycle is near its end and despite still constructive dollar, however, more work on either side will be required to generate clearer direction signal.

Bullish scenario requires sustained break above $1970/73 pivots to signal an end of $2009/$1931 corrective phase and confirm continuation of recovery from $1931 higher low (underpinned by a bear-trap under 200DMA).

Caution on repeated failure at $1970/73 zone which would boost signals that recovery is running out of steam, which would keep at risk lower pivots at $1936/33 (200DMA / Fibo 38.2% of $1810/$2009) loss of which to generate signal of bearish continuation of the leg from $2009 (Oct 27 high) on completion of failure swing pattern on daily chart.

Res: 1970; 1973; 1979; 1991

Sup: 1954; 1943; 1936; 1933