Gold remains in red and eyes key supports

Gold price fell further on Tuesday morning after two-day sharp fall (down 2.5%) paused on Monday.

Stronger dollar on growing expectations that US interest rates will remain elevated, keeps the metal’s price under pressure.

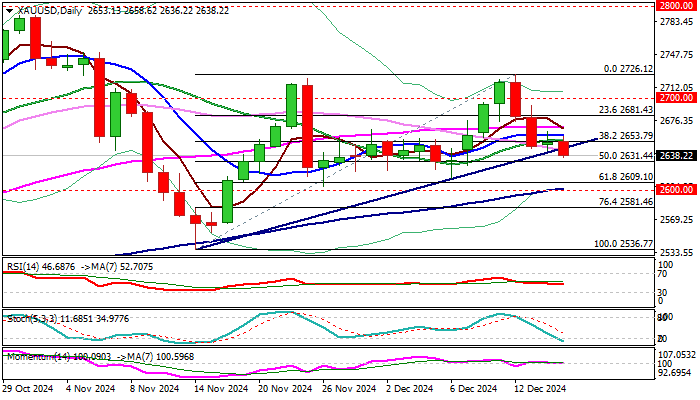

Fresh bears broke today below trendline support ($2643) and approach pivotal support at $2630 (daily cloud base, reinforced by Kijun-sen), loss of which could spark acceleration towards $2613 (Dec 6 higher low) and $2605/00 (100DMA / Nov 26 low / psychological).

In such scenario, a double top pattern ($2721/26) will be completed and risk further weakness, with $2536 (Nov 14 low) likely to come in focus.

Last week’s Doji candle with long upper shadow warns that offers remain strong, adding to negative signals.

Technical picture on daily chart is weakening (10/20/55DMA’s turned to bearish setup / falling 14-d momentum cracks the centreline) however broader short-term sideways mode likely to remain intact while the price stays above $2600 zone.

All eyes are on Fed, as the central bank is widely expected to cut rates by 25 basis points at the end of two-day policy meeting on Wednesday), though prospects for more aggressive easing fade on facts that inflation remains elevated and may rise further, on Trump’s plans to strongly boost the economy after he starts his second term in the White House.

Res: 2653; 2660; 2667; 2681

Sup: 2630; 2613; 2600; 2581