GBPUSD – recovery picks up and cracks pivotal barriers, ahead of FOMC decision

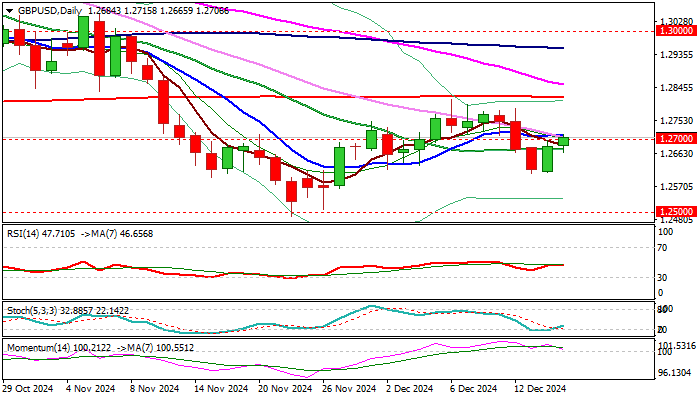

GBPUSD extends recovery into second consecutive day and cracks important barriers at 1.2700/14 (psychological / 10DMA), but without break higher so far.

Monday’s bounce generated initial positive signal on completion of bullish engulfing pattern on daily chart, with today’s fresh extension higher, looking for sustained break above 1.2700/14 pivots to confirm signal and open way for further recovery.

Broader technical picture is predominantly bearish and warning about possible recovery may stall (south-heading 14-d momentum is approaching the centreline, MA’s mainly in bearish setup and converging 55/200DMA on track to for a death cross).

Such scenario could be well supported by anticipated Fed’s hawkish cut on Wednesday, as the US central bank may reduce the speed and diverge from expected rate cut path in 2025, due to new reality (inflation remains elevated and may rise further on expected strong boost to the US economy by Trump’s administration) that would further inflate dollar.

Broken 20DMA (1.2673) offers immediate support, guarding more significant 1.2600 zone (higher base / psychological)

Res: 1.2750; 1.2787; 1.2817; 1.2852

Sup: 1.2673; 1.2617; 1.2600; 1.2565