Gold rises as renewed trade uncertainty prompted traders into safe-havens

Spot gold rallied on fresh safe-haven demand on Thursday, after China expressed doubts about signing any deal with the US that increased uncertainty over ongoing trade conflict.

Yellow metal was boosted by dovish Fed on Wednesday which deflated dollar, with renewed pessimism about trade war, adding to fresh risk-off mode in the markets.

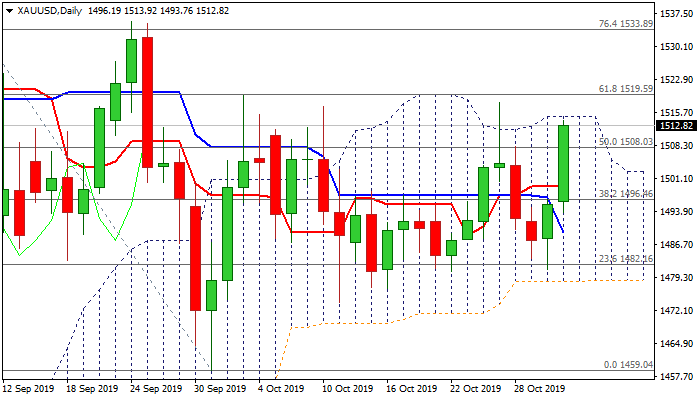

The metal returned back above $1500 handle in strong bullish acceleration, as reversal of $1517/$1481 pullback was signaled by Wednesday’s bullish outside day pattern.

Thursday’s rally brought daily MA’s into bullish setup and north-heading momentum broke into positive territory, supporting fresh bulls.

Daily cloud top ($1514) is under pressure and break higher will expose another key barrier at $1519 (Fibo 61.8% of $1557/$1459, also the ceiling of short-term range) violation of which would open way towards $1533/35 barriers (Fibo 76.4% / 23/24 Sep tops).

Supports lay at $1504 (55DMA) and psychological $1500 level (also broken daily Tenkan-sen) which is expected to hold extended dips and keep bulls in play.

Res: 1514; 1519; 1524; 1533

Sup: 1510; 1504; 1500; 1496