Gold rises further and on track for the biggest weekly gains in over six months

Gold price rose to the highest in more than two weeks on Friday, as bulls regained control after pausing on Thursday, following short-lived drop, inspired by higher than expected US inflation in September.

Prevailing view that Fed’s tightening cycle is near its end offset potential stronger impact from elevated Sep consumer prices, offering fresh support to bullion, already underpinned by increased safe haven demand on growing uncertainty over the latest crisis in the Middle East.

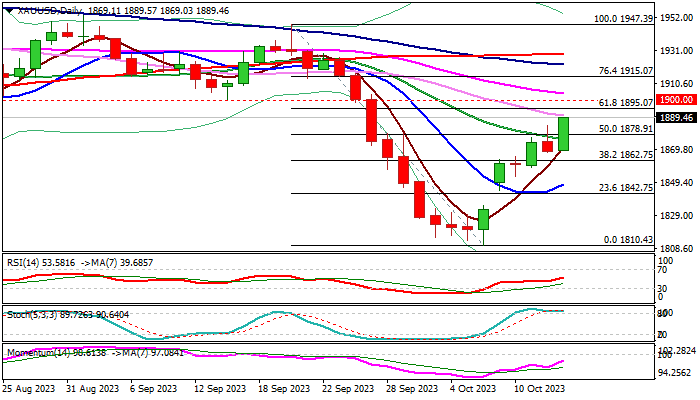

Fresh extension of recovery leg from $1810 (Oct 6 low) retraced over 50% of $1947/$1810 bear-leg), exposing key barriers at $1895/$1900 (Fibo 61.8% / psychological) and increasing the prospects for further gains on break.

Bullishly aligned daily studies also support recovery, while this week’s action (the biggest weekly gain since mid-March) is about to form a large weekly bullish candle and form reversal pattern on weekly chart, contributing to initial positive signal from last week’s bear-trap under 200WMA.

Broken Fibo 50% and 20DMA ($1878/76) should keep the downside protected.

Res: 1890; 1895; 1900; 1915

Sup: 1878; 1869; 1862; 1853