GOLD stays in red on stronger dollar, pressures pivotal supports at $1336/34

Spot Gold continues to move lower on stronger dollar, trading in red for the third straight day.

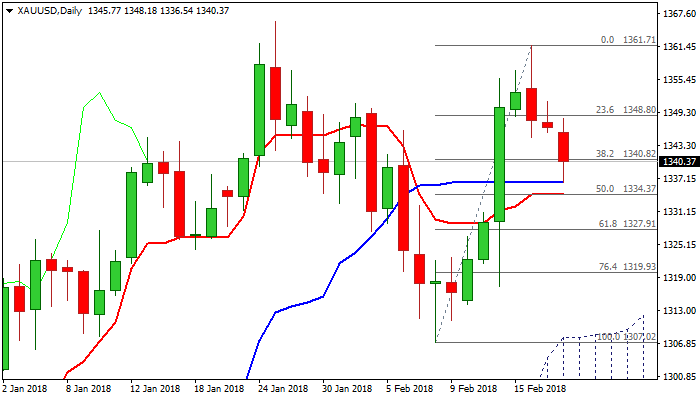

Fresh weakness commenced after strong upside rejection at $1361 on Friday and extended to one-week low at $1336 on Tuesday, where daily Kijun-sen offered temporary footstep.

Near-term bears face strong headwinds from $1336 (daily Kijun-sen) / $1334 (daily Tenkan-sen / 10SMA) support zone, loss of which would generate another bearish signal and risk weakness towards $1328 (Fibo 61.8% of $1307/$1361 upleg).

Stronger greenback keeps reduced demand for safe-haven gold which could keep the price under increased pressure.

Close below $1340 (cracked Fibo 38.2% of $1307/$1361) today is needed for bearish signal to maintain pressure on gold price.

Failure to clearly break $1340 would ease immediate bearish pressure but the downside is expected to remain at risk while the price stays below pivotal $1350 resistance.

Res: 1344; 1348; 1350; 1352

Sup: 1336; 1334; 1328; 1320