Gold surges as strong NFP miss prompts traders into safety

Spot gold surged to new 2 ½ week high on Friday, following strong US NFP miss, as the report from US Labor Department showed that employment increased far less than expected in September.

Downbeat figures (Sep 194K vs 500K f/c and upwardly-revised Aug figure to 366K) raised concerns about economic growth as well as the start of reducing Fed’s massive bond-buying, expected as early as November and prompted investors into safe-haven yellow metal.

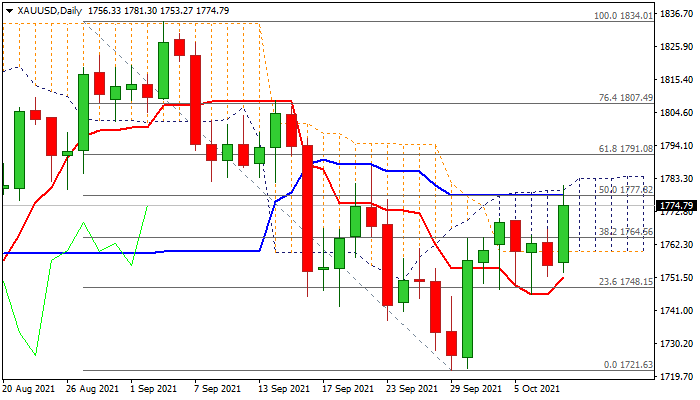

Fresh rally cracked strong barriers at $1777/79 (50% retracement of $1834/$1721 / daily Kijun-sen / daily cloud top), with today’s close above thickening daily cloud to generate strong bullish signal for continuation of recovery rally from $1721 (Sep 29 low) towards next key levels at $1791 (Fibo 61.8%) and $1800 (psychological / 200DMA).

Improving daily studies (5/10/20 DMA’s turned to bullish configuration and positive momentum is rising) add to renewed bullish sentiment and support the action.

Fresh bulls see close above $1764 (broken Fibo 38.2% of $1834/$1721) as a minimum requirement to remain in play.

Alternative scenario sees return and close below 10DMA ($1754) which contained an action in past few days, as strong bearish signal.

Res: 1781; 1791; 1800; 1804

Sup: 1770; 1764; 1754; 1745