AUDUSD bulls lose traction ahead of US NFP data

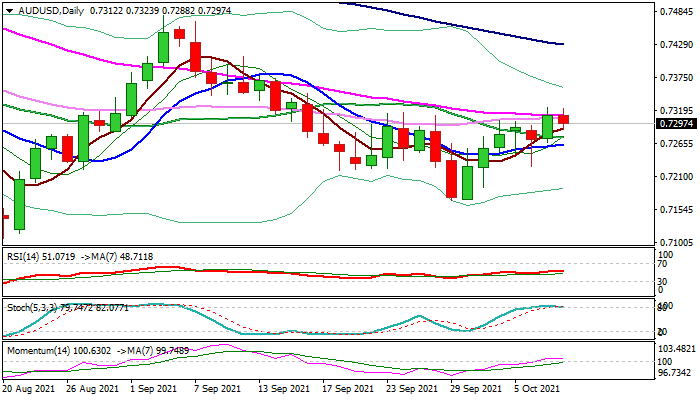

The Australian dollar dipped below 0.73 mark in Europe on Friday after the action was repeatedly capped by daily Kijun-sen (0.7324), pressured by higher dollar ahead of US jobs report.

Daily technical studies generate initial negative signal as stochastic is about to reverse from overbought territory and bullish momentum started to fade, but near-term direction is likely going to be defined by US NFP report.

Forecasts for strong figures in September keep the US dollar underpinned, with release around/ above consensus to lift the greenback.

Aussie faces pivotal supports at 0.7174/63 (converging 20/10DMA’s) close below which would weaken the structure, with return and close below 200WMA (0.7211) to strengthen bearish grip and open way for test of 0.7170 trough (Sep 29/30 lows), which guards 2021 low at 0.7106 (Aug 20).

Conversely, close above daily Kijun-sen (also 50% retracement of 0.7478/0.7170) would sideline downside risk, while extension through 0.7360 (daily cloud top / Fibo 61.8%) would confirm reversal and shift focus to the upside.

Res: 0.7324; 0.7360; 0.7376; 0.7405

Sup: 0.7287; 0.7262; 0.7248; 0.7193