Gold surges towards $2000 on safe-haven buying as war in Ukraine starts

Spot gold advanced over 3% this morning, hitting the highest since September 2020, as traders massively run into safety after Russia launched a military action against Ukraine.

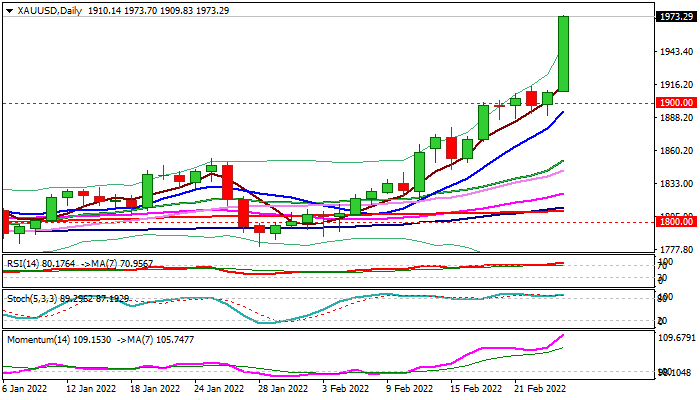

Strong bullish acceleration rose well above $1950, with Fibo barrier at $1980 (76.4% of $2074/$1676) to likely easily surrender and open way for renewed test of psychological $2000 level, which was dented in August 2020, during coronavirus pandemic, but break proved to be false and followed by strong pullback to $1676.

Rising uncertainty on fears that current conflict, which is still limited, could escalate, strongly inflates gold price, which is on track for a record monthly gains in February.

Renewed probe through $2000 level looks very likely now, with break higher to face targets at $2015 and $2049, ahead of a record high at $2074, posted on August 2020.

The metal’s performance will directly depend on the development of the situation in Ukraine, with dips so far seen as good buying opportunities.

Supports lay at $1950 (round-figure / upper 20-d Bollinger band); $1914 (former high of Feb 22) and psychological $1900 level.

Res: 1980; 2000; 2015; 2049

Sup: 1950; 1924; 1914; 1900