Gold turns to sideways mode, awaiting fresh signals from Jackson Hole meeting

Gold is holding within a narrow consolidation, just above new five-month low, for the second consecutive day.

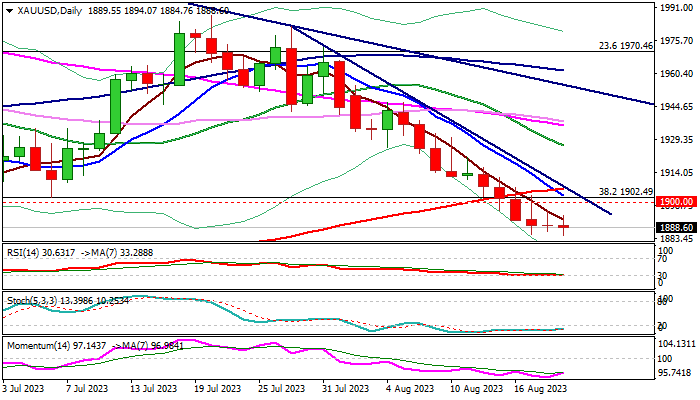

Larger bears started to lose steam after four straight weeks of losses (down 3.6%), as traders reduced pace on oversold daily studies and awaiting fresh signals for interest rates and an outlook on the economy, from the annual gathering of central bankers in Jackson Hole.

The second consecutive daily Doji candle signals strong indecision, with possibility of extended consolidation until markets get fresh direction signal, as all eyes turn on Aug 24-26 Jackson Hole Symposium and speech of Fed Chair Jerome Powell (due on Aug 25).

The main question will be whether the US central bank will keep high interest rates for extended period, in the environment of sticky inflation, or it will start to reduce the borrowing cost in coming months.

The yellow metal may come under increased pressure if the Fed sticks to the policy of higher for longer interest rates, which would keep the greenback attractive for investors, though persistently high inflation may revive metal’s appeal as a hedge against inflation and lift the price.

We will look for fresh direction signals on sustained break above 200DMA ($1906) – bullish, or firm break below the recent five-month low ($1884) – bearish.

Bearish acceleration would expose target at $1847 (100DMA / 50% retracement of $1614/$2080 rally) and risk extension towards $1800 zone (Feb 26 trough / 200WMA).

Conversely, lift above (200DMA / trendline resistance) would open way for test of pivotal barriers at $1924 (Fibo 38.2% of $1987/$1884 bear-leg) and $1933 (base of thinning daily cloud, which twists next week and expected to be magnetic).

Res: 1891; 1900; 1906; 1924

Sup: 1884; 1871; 1847; 1834