Growing recession fears fuel downside risk

Cable kept weak tone in European session on Friday and fell to one week low after quite mild reaction on BoE’s 50 basis points rate hike on Thursday, as the pair traded in a choppy mode after rate decision, but the action stayed capped under key barriers (200WMA / monthly cloud base), keeping bearish pressure.

Dips were limited by slightly better than expected UK retail sales in May, but the sentiment was again soured by UK PMI data, which came below forecasts in June.

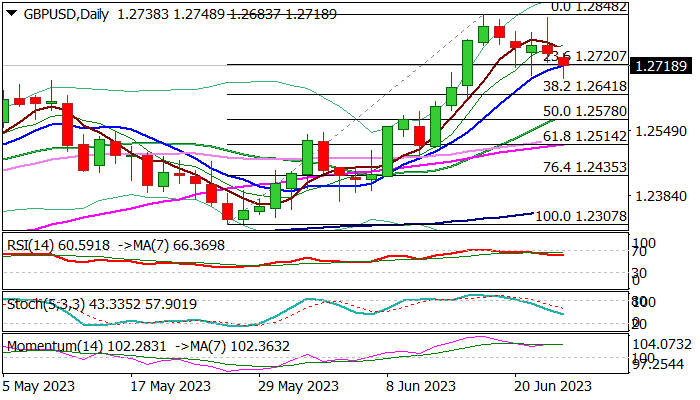

Technical studies on daily chart are weaker but still bullish overall, with growing pressure seen from expectations that the UK economy could slide into recession after BoE’s jumbo hike on Thursday, which could drive the pound lower.

Fresh extension lower broke through pivotal support at 1.2720 (Fibo 23.6% of 1.2307/1.2848, reinforced by rising 10DMA), which so far resisted three consecutive attacks, with firm break here to add to initial reversal signal and risk deeper pullback.

Caution on repeated failure to clearly break below 10DMA, which would keep the price action in extended consolidation, but biased lower as long as it stays below 200WMA.

Res: 1.2758; 1.2806; 1.2848; 1.2875

Sup: 1.2683; 1.2641; 1.2578; 1.2534