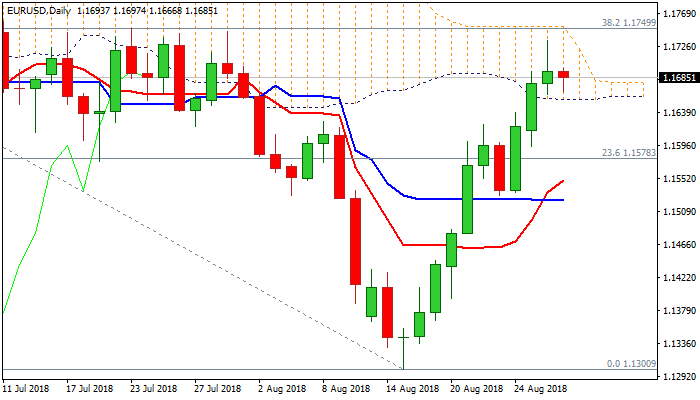

Hesitation at daily cloud top could result in deeper pullback

The Euro stands in red in early Wednesday’s trading, easing from new recovery rally high at 1.1733, after bulls failed on approach to key barrier at 1.1750 (daily cloud top / Fibo 38.2% of 1.2476/1.1300 / falling 100SMA).

The price holds for now within thinning daily cloud on mixed signals as momentum continues to strengthen, while slow stochastic created bear-cross and attempting out of overbought territory.

Overall bullish structure favors further upside, as concerns about US-China trade dispute keep the dollar under pressure, with consolidative / corrective phase expected to precede fresh advance.

Break above 1.1750 would open way towards next pivots at 1.1780/90 (Fibo 38.2% of 1.2555/1.1300 / 09 July lower top, break of which is expected to generate bullish signal for stronger correction of 1.2555/1.1300 (19Feb / 15 Aug fall).

Daily cloud base offers solid support at 1.1656, but risk of deeper pullback exists. Extended dips below 1.1656 would look for test of 55SMA (1.1613) and could travel towards strong support at 1.1568 (Fibo 38.2% of 1.1300/1.1733 ascend, reinforced by rising 10SMA).

Res: 1.1700; 1.1733; 1.1750; 1.1780

Sup: 1.1656; 1.1631; 1.1613; 1.1568