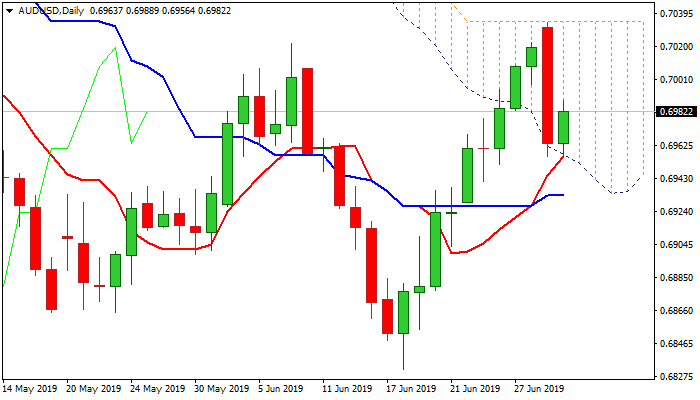

Holding within thick daily cloud keeps larger bulls alive

The Australian dollar bounced from 0.6956 (Monday’s low, posted after the biggest one-day loss since 24 Apr) in early Asian trading on Tuesday.

Monday’s pullback from new recovery high at 0.7034 (capped by daily cloud top / 100DMA) was contained by key supports at 0.6956 (daily cloud base / Fibo 38.2% of 0.6831/0.7034 / rising 10SMA).

The pair showed mild reaction on anticipated RBA rate cut by 0.25%, with rather dovish tone of the statement, as the central bank left door open for further easing.

Weaker US dollar despite the agreement between the USA and China for ceasefire and continuation of trade talks, helped Aussie’s recovery.

Immediate downside risk from Monday’s bearish engulfing is sidelined, with repeated close within thick daily cloud expected to keep bulls alive, as bullish momentum remains strong and offsets for now negative signals.

Return and close above psychological 0.70 barrier would add to positive signals, however, sustained break above daily cloud top / 100DMA is needed to confirm bullish continuation.

On the other side, key support at 0.6956 is still vulnerable and close below is needed to confirm reversal and open way for deeper correction of 0.6831/0.7034 upleg.

Res: 0.7000; 0.7022; 0.7035; 0.7048

Sup: 0.6956; 0.6945; 0.6933; 0.6909