Israeli Shekel comes under pressure again after a limited and short-lived impact of intervention

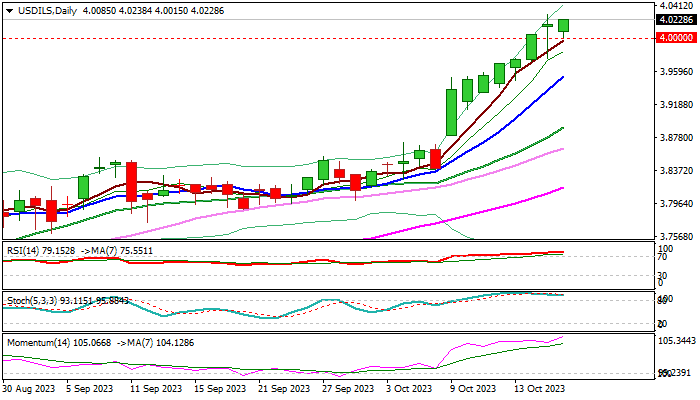

The USDILS returns above 4.00 mark on Wednesday, following short-lived impact from a partial intervention from the Bank of Israel on Tuesday.

The pair dipped below 3.98 on pullback from new multi-year high at 4.0290, but fresh escalation on deadly blast in Gaza hospital revived pressure on Shekel, reversing the largest part of Tuesday’s 4.0290/3.9755 dip.

Darkening near-term outlook on fears that the conflict may escalate further and possibly spread outside the current borders, is likely to further pressure Shekel, as fresh gains approach Tuesday’s peak and break higher.

Fibo expansion marks next target at 4.0596, with challenge of psychological 4.10 barrier not ruled out on stronger acceleration.

It seems that the central bank’s actions will have limited influence on the currency direction, as Tuesday’s dip and subsequent quick bounce proved that downside pressure on Shekel remains very strong, despite that the Bank of Israel has already spent around the third of its intervention fund, estimated at $30 billion, in attempts to curb Shekel’s recent strong fall.

Weekly close above 4.00 mark to confirm strong bullish stance and keep focus at the upside, as geopolitics remain pair’s main driver in coming days / weeks.

Res: 4.0290; 4.0416; 4.0596; 4.0668

Sup: 4.0000; 3.9843; 3.9755; 3.9530