Japanese yen accelerates gains vs dollar on growing signals of BoJ policy shift

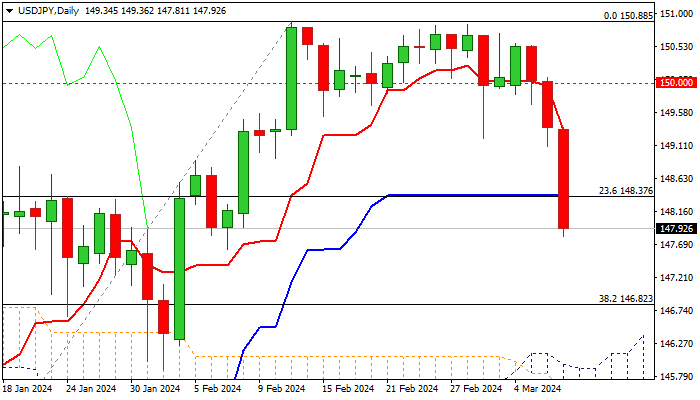

Bears accelerate on Thursday (USDJPY was down 1% in Asian / European session) extending steep fall into third straight day.

Fresh weakness broke below initial Fibo support at 148.37 (23.6% of 140.25/150.88 rally, reinforced by daily Kijun-sen) generating initial reversal signal and warning of deeper drop.

Bears cracked 100DMA (147.81) which produced some headwinds, with break lower to open way towards targets at 146.82 (Fibo 38.2%) and 146.10 (200DMA).

Momentum indicator on daily chart is heading south, deeper into negative territory and contributes to negative near-term outlook.

Japanese yen strengthened (on track for the biggest daily gain vs US dollar this year) on growing speculations that the Bank of Japan could start raising interest rates this month and further signals that the Fed would start cutting interest rates in coming months, which further deflated the greenback.

Res: 148.37; 149.00; 149.34; 150.00

Sup: 147.62; 147.33; 146.82; 146.10