Limited pullback keeps bulls intact for fresh push higher

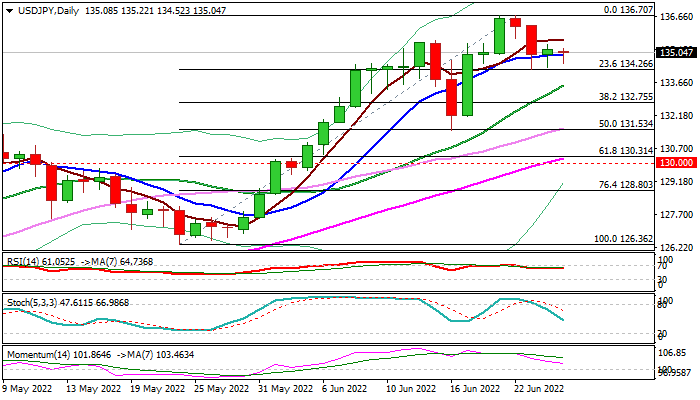

The USDJPY is trading within a narrow range in early Monday, after a pullback from new multi-year high (136.70) was repeatedly limited by Fibo 23.6% of 126.36/136.70 upleg (134.26) with another positive signal seen on repeated failure to close below cracked 10DMA (134.95) that keeps near-term bias positive.

Limited correction so far keeps overall bullish structure intact despite weakening bullish momentum on daily chart, however, weekly Doji with long upper shadow and overbought conditions warn of extended consolidation or possible deeper dips and require caution.

The pair is on track for strong monthly gains after steep rally in past three months paused in May, signaling that a larger uptrend remains intact and bulls eye retest of 136.70 peak, violation of which would signal bullish continuation.

Immediate focus is expected to remain at the upside while the near-term action stays above 10DMA and 134.26 Fibo support, while break here would open way for dips towards 132.75 (Fibo 38.2% of 126.36/136.70) which should contain and protect lower pivot at 131.53 (50% retracement / daily Kijun-sen / June 16 trough).

Res: 135.59; 136.27; 136.70; 137.28

Sup: 134.26; 134.09; 133.53; 132.75