The Euro stands at the front foot but bulls need more work at the upside to sideline downside risk

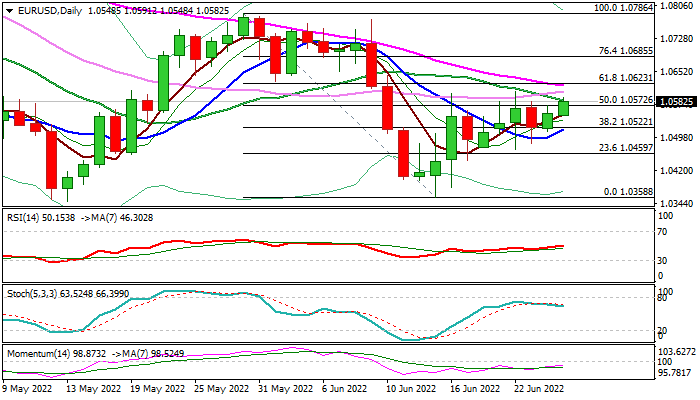

The Euro keeps positive tone at the start of the week and penetrates again thick daily cloud after last week’s rallies failed to register a daily close within the cloud for the four consecutive times.

Fresh bulls attempt to break above the top of three-day range and probe above pivotal barrier at 1.0623 (Fibo 61.8% of 1.0786/1.0358 bear-leg), close above which would strengthen near-term structure and allow for stronger recovery.

On the other side, daily studies are still overall negative, signaling that the downside remains vulnerable.

Failure to clear 1.0623 Fibo barrier would generate initial signal of possible recovery stall, while repeated rejection under daily cloud base, would add to negative signals and risk fresh drop.

Res: 1.0605; 1.0623; 1.0685; 1.0700

Sup: 1.0548; 1.0522; 1.0482; 1.0444