Bulls are expected to resume after correction as the dollar remains supported by strong safe haven demand on growing uncertainty

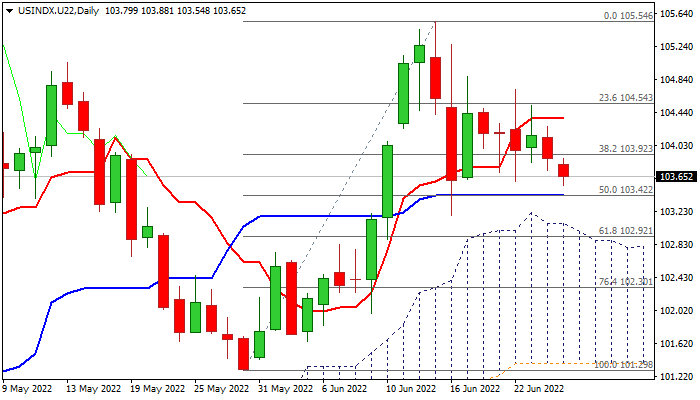

The dollar index eases further on Monday after recovery attempts repeatedly failed to clear 10DMA (currently at 104.18).

Fresh bears pressure solid support at 103.42 (daily Kijun-sen / 50% retracement of 101.29/105.54 upleg) which guards more significant support levels at 103.18/102.98 (June 16 spike low / top of thick daily cloud).

Extended dips should stay above these supports to keep larger bulls intact for fresh push higher, as current action is a corrective phase of a larger uptrend.

The dollar remains strongly supported by safe-haven demand on expectations of higher interest rates and growing prospects of recession, as major economies continue to slow.

Res: 103.92; 104.19; 104.54; 104.87

Sup: 103.42; 103.18; 102.98; 102.73