Limited recovery keeps in play risk of retesting key 1.10 support zone

The Euro is holding within narrow range in early European trading on Friday after recovery attempts from key 1.10 support zone stalled.

Downbeat German retail sales were offset by jobs data which showed significant drop in unemployment, keeping the single currency afloat, as markets await EU inflation data (CPI y/y Nov 0.9% f/c vs 0.7% prev).

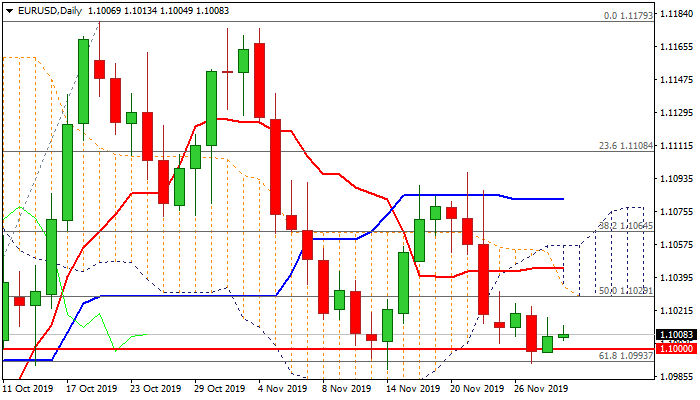

Weakening momentum on daily chart keeps in play risk of renewed attack at key 1.10 zone supports as thickening daily cloud weighs.

Firm break below 1.1000/1.0989 pivots (psychological / Fibo 61.8% of 1.0878/1.1179 / 14 Nov trough) is required to generate strong negative signal for continuation of larger downtrend and expose supports at 1.0949 (Fibo 76.4%) and 1.0940 (8 Oct trough).

Alternatively, lift above broken bull-trendline (1.1025) would provide relief, but only extension above daily cloud (spanned between 1.1029 and 1.1057) would sideline bears.

Res: 1.1025; 1.1044; 1.1057; 1.1082

Sup: 1.1000; 1.0989; 1.0949; 1.0940