Lira advances after stronger than expected CBRT rate cut but gains might not be long-lasting

The Turkish lira jumped 1.2% against US dollar after Turkey’s central bank surprised by cutting interest rates more than expected in its policy meeting today.

The CBRT reduced interest rate by 325 basis points to 16.5% against expectations for 250 basis points cut.

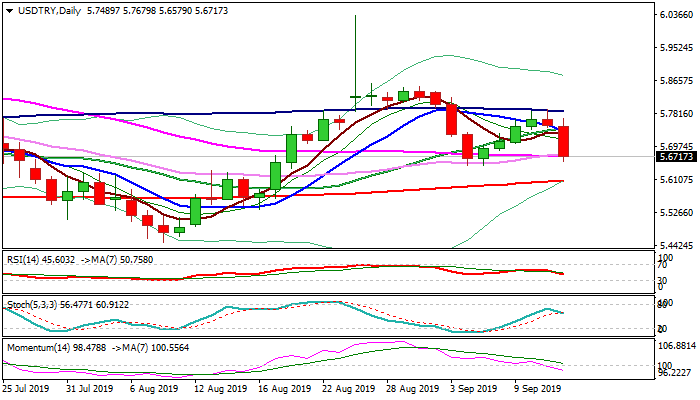

The pair dipped from pre-decision levels at 5.76 area to 5.66 zone, where converged 55/30DMA’s offered support and cushioned fall.

Fresh weakness comes after 100DMA and daily cloud top (5.7870 & 5.7701 respectively) repeatedly capped upside attempts.

Risk of break below 55DMA and higher base at 5.6480 that would complete failure swing top pattern on daily chart and spark fresh bearish acceleration towards key supports provided by 200DMA (5.6067) and daily cloud base (5.5865) exists, but overall lira’s sentiment remains weak and suggests that extended dips may not be long-lasting.

Next week’s Fed policy decision may further boost dollar, already inflated by rising risk sentiment and bring lira back to red territory.

Res: 5.7043; 5.7295; 5.7524; 5.7870

Sup: 5.6579; 5.6480; 5.5865; 5.5626