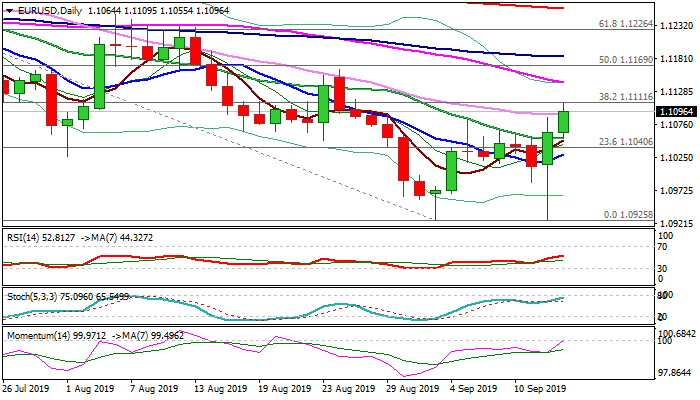

Strong rebound cracks key Fibo barrier and looks for further extension on break

The Euro extends strong rebound after post-ECB failure at 2019 low (1.0926) and cracks 1.11 barrier in early European trading.

Near-term sentiment turned positive after initial dip after ECB’s decision was contained by 3 Sep yearly low and subsequent bounce was fueled by profit-taking.

President Trump’s strong criticism of Fed and very strong dollar that hurts US economy, contributed to fresh Euro’s rally.

Strong recovery left double-bottom (1.0926), broke above bear-trendline off 1.1214 top (1.1093) and currently pressuring important Fibo barrier at 1.1111 (38.2% of 1.1412/1.0925), with action being supported by rising daily momentum (attempting to break into positive territory) and 10/20/30DMA’s turned to bullish setup and starting to point up.

Fresh bulls need weekly close above 1.1111 pivot (which capped a number of attacks in the second half of August) to generate signal for recovery extension towards another significant barrier at 1.1142 (base of daily cloud spanned between 1.1142 and 1.1219 / 55DMA).

Broken 20DMA offers solid support at 1.1054 which needs to hold and keep fresh bulls in play.

On the other side, weekly chart shows larger downtrend intact, with current rally seen as positioning ahead of next key market event-Fed policy meeting next week.

Wide expectations for Fed rate cut by 25 basis points and fresh optimism over US/China trade talks, are expected to inflate dollar and put the single currency under renewed pressure.

Res: 1.1111; 1.1142; 1.1163; 1.1183

Sup: 1.1078; 1.1054; 1.1029; 1.1000