Lira bounces from new record low on intervention; all eyes on CBRT policy meeting this week

The USDTRY fell around 6% on Monday, following an initial rally to the new all-time high near 15.00 marks and subsequent quick pullback, sparked by CBRT’s intervention.

The Turkish central bank intervened for the fourth time in two weeks by selling dollar in attempts to at least slow the fall of the national currency.

Lira has lost ground and registered heavy losses against the dollar and Euro this year, mainly due the decisions of the central bank which continued to cut interest rates while inflation was hitting record highs and currently standing around 20% that prompted investors to sell it, with the biggest drop seen in November, when Turkish currency fell around 40% against the dollar.

The interventions proved to be short-lived support, as lira continued to extend its fall, with growing fears that it could accelerate further on expectations that the CBRT will further cut interest rates by 1% to 14% in the policy meeting this week.

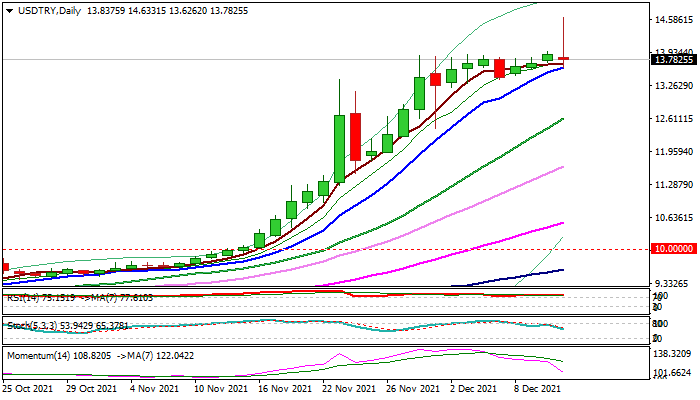

This would further weaken the sentiment and send lira through 15.00 barrier, towards Fibonacci expansion levels at 15.2700 (238.2%) and 16.0998 (261.8%) of the extended third wave of five-wave cycle from Dec 2018 low at 5.1367.

However, lira may gain traction in case the CBRT stays on hold that would offer more space for consolidation and possible pullback as weekly studies are overbought.

Rising 10DMA offers immediate support at 13.6254, followed by ascending 20DMA (12.6059), loss of which would lead to deeper correction.

Res: 13.9546; 14.6331; 14.9577; 15.2700

Sup: 13.6254; 13.2357; 12.6059; 12.4133