Lira extends weakness after Q1 GDP missed expectations, warning of contraction

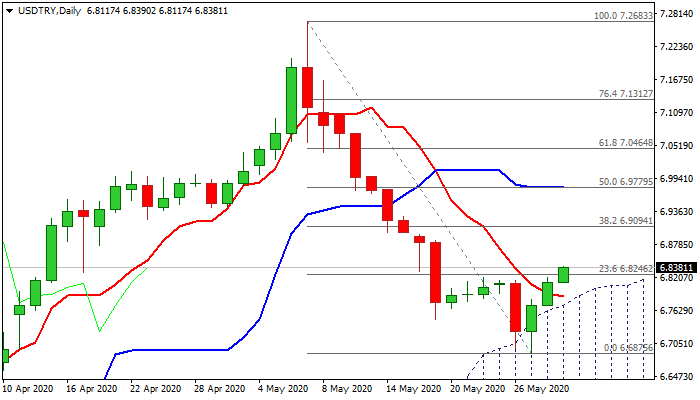

The USDTRY advances for the third straight day after pullback from new record high was contained by rising thick daily cloud.

Recovery broke above initial barriers at 6.80 zone (converged 10/55DMA’s) and 6.8246 (Fibo 23.6% of 7.2683/6.6875), generating initial signal that correction might be over.

Lira was additionally pressured by Turkey’s GDP data which showed slower than expected economic growth in the first quarter (Q1 GDP 4.5% vs 5.4% f/c).

Despite optimism that the economy will pick up during 2020, analysts remain pessimistic and point at grim outlook in the second half of the year.

Technical studies support the recovery with more positive signals seen on weekly chart, where weekly hammer is forming, while bullish momentum is regaining traction and ascending daily cloud continues to underpin.

Fresh bulls need to regain key barriers at 6.9094/6.9180 (Fibo 38.2% of 7.2683/6.6875 / 20DMA) to neutralize existing downside risk and open way for further recovery.

Res: 6.8714; 6.8850; 6.9094; 6.9180

Sup: 6.8246; 6.8000; 6.7886; 6.7460