Lira falls further and pressures key barriers on US sanctions threats; CBRT in focus

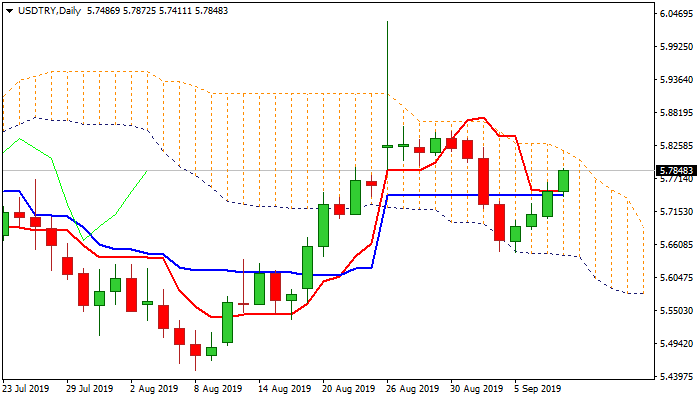

The USDTRY pair holds in green for the fourth day and extends advance from 4/5 Sep double-bottom (5.6480) to pressure key barriers at 5.7908 (100 DMA) and 5.8031 (daily cloud top) on Tuesday.

Lira’s sentiment weakened on threats of US sanctions over Turkey’s purchase of Russian missile system that increases pressure on Turkish currency and risk of significant fall on break through 100DMA / cloud top pivots, as Turkey’s central bank is likely to cut interest rates on Thursday that would add to negative outlook.

Recent highs at 5.90 zone would come in focus if USDTRY bulls emerge from daily cloud, with extension towards 5.9408 (Fibo 61.8% of 6.2445/5.4494) not ruled out in case of stronger bullish acceleration.

Rising 20DMA (5.7331) marks pivotal support.

Res: 5.7908; 5.8031; 5.8228; 5.8497

Sup: 5.7606; 5.7411; 5.7331; 5.7000