Lira remains at the back foot and pressures cracked pivotal support

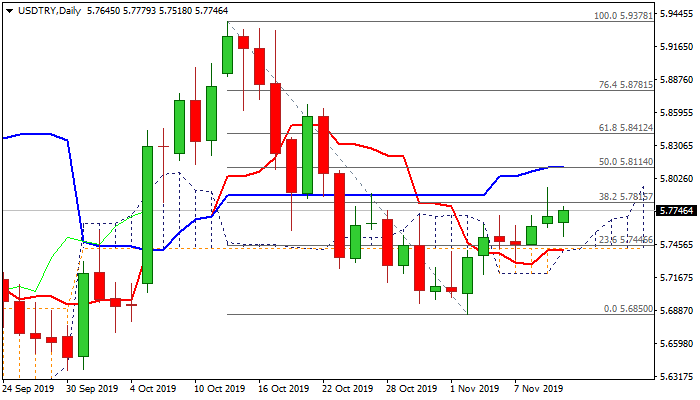

The USDTRY pair extends bounce from 5.6850 (4 Nov low) where rising 200DMA contained bear-leg from 5.9378 (14 Oct high).

Recovery returned above ascending and thickening daily cloud which twisted today and underpins the action.

Monday’s rally was rejected after failure to hold gains above pivotal barrier at 5.7816 (Fibo 38.2% of 5.9378/5.6850) but bulls remain in control for renewed attempt higher.

A cluster of daily MA’s turned to bullish setup and daily momentum emerged into positive territory, supporting the scenario, but sideways-moving stochastic (just under overbought zone border) warns that bulls might be delayed further for consolidation before final break above 5.7816 pivot.

Top of rising daily cloud (5.7410) needs to hold dips and keep bulls in play.

Converging 100/200DMA’s (5.7082/5.6985) mark lower pivots, loss of which will be bearish.

Break above 5.7816 would open daily Kijun-sen (5.8114, also 50% retracement of 5.9378/5.6850).

Res: 5.7816; 5.7944; 5.8114; 5.8412

Sup: 5.7518; 5.7410; 5.7082; 5.6985