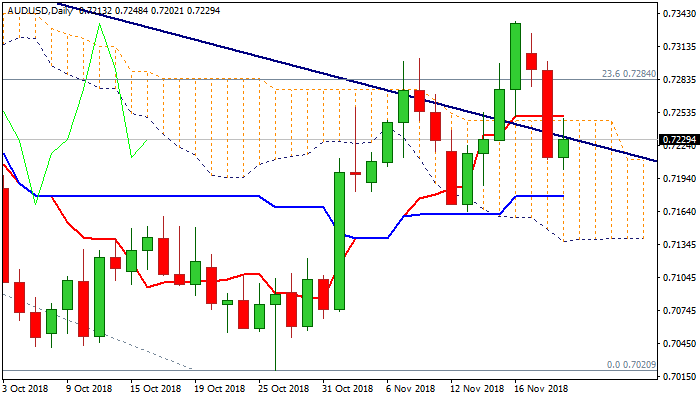

Long red candle weighs; failure at cloud top to maintain downside risk

The Australian dollar is in recovery mode on Wednesday, after suffering heavy losses previous day when the pair was down over 1% in the biggest one-day fall in Nov.

Bounce from one-week low at 0.7202 faces strong headwinds from daily cloud top (0.7247) reinforced by 10SMA and failure here would signal that recovery attempts are out of steam.

Tuesday’s long bearish daily candle weighs, with south-heading momentum and slow stochastic on daily chart adding to existing downside risk.

Bearish signal could be expected on repeated close below cracked Fibo support at 0.7215 (38.2% of 0.7020/0.7335), with extension below rising 20SMA (0.7199) to signal extension of pullback from 0.7335 (16 Nov high).

Lift and close above falling daily cloud would sideline downside risk and open way for fresh recovery.

Res: 0.7247; 0.7268; 0.7300; 0.7335

Sup: 0.7215; 0.7199; 0.7178; 0.7170