Loonie surges on stronger than expected Canada’s GDP data

The pair fell sharply on announcement of upbeat Canada’s GDP (Jan 0.3% m/m vs 0.1% f/c and -0.1% prev) while US personal income and spending fell below expectations in Jan.

Canadian dollar was inflated by stronger than expected data while the greenback was additionally pressured by weak US figures.

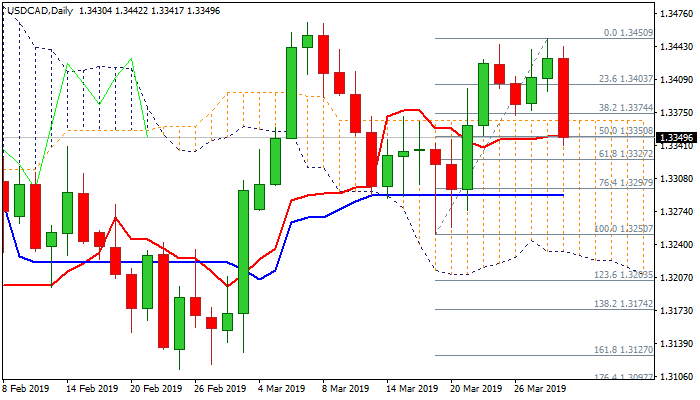

Fresh bearish acceleration left top at 1.3450 and penetrated thick daily cloud (top of the cloud lays at 1.3366, retracing so far over 50% of 1.3250/1.3450 upleg.

Rising bearish momentum and south-heading slow stochastic (which reversed from overbought zone and shows a plenty of space at the downside) support fresh bears, with brighter sentiment for the loonie after strong data, add to positive near-term outlook.

Bears look for pivotal supports at 1.3327/11 (Fibo 61.8% / converged 30/100SMA’s) close below which would generate fresh bearish signal and unmask support at 1.3250 (19 Mar trough).

The pair is on track for bearish weekly close that could generate stronger negative signal on formation of weekly bearish engulfing, which requires close below 1.3330 mark.

Alternatively, return and close above daily cloud would ease bearish pressure.

Res: 1.3366; 1.3403; 1.3450; 1.3467

Sup: 1.3327; 1.3311; 1.3282; 1.3250