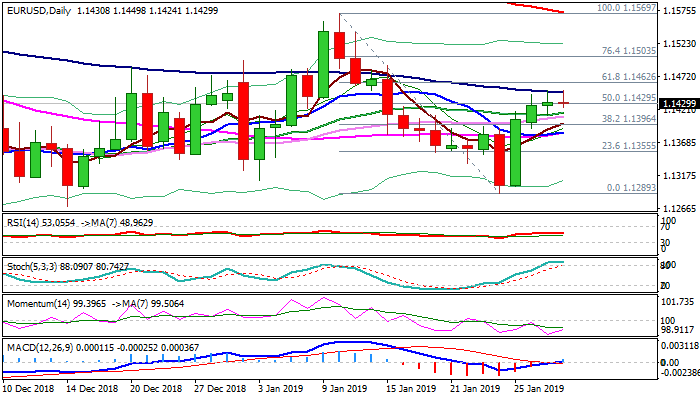

N/t action remains congested between cloud top and 100SMA; Tuesday’s Doji adds to mixed outlook

The Euro shows strong indecision following break above daily cloud, as Tuesday’s trading ended in Doji candle and the action of early Wednesday was so far in the same shape and remains capped by 100SMA (1.1447).

Mixed daily studies (negative momentum and overbought slow stochastic) conflict bullishly aligned MA’s (10/20/30/55) and lack clearer signal.

Bullish bias is expected to remain in play while the price holds above cloud top (1.1418, reinforced by rising 20SMA), but risk of fresh weakness would exist as long as 100SMA caps.

Breach of either pivot (100SMA at the upside or cloud top / 20SMA at the downside would generate initial direction signal.

Bullish scenario would look for confirmation on lift above 1.1462 (Fibo 61.8% of 1.1569/1.1289), while further negative signal could be expected on extension below 1.1387 (converged 10/55SMA’s).

Mixed German data (better than expected consumer climate was offset by downbeat export/import data) made little impact at the pair, with focus turning towards German CPI data and Fed policy decision, which would provide fresh signals.

Res: 1.1447; 1.1462; 1.1489; 1.1503

Sup: 1.1418; 1.1396; 1.1387; 1.1377