Near-term action on course for the second Doji on conflicting fundamentals

The pair eased in early US trading on Thursday as smaller than expected, although near the highest levels US jobless claims, offset dollar’s positive tone on President Trump’s earlier support to strong US currency.

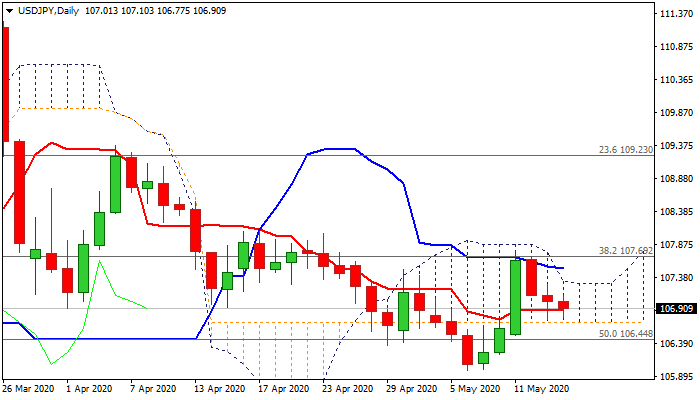

Near-term action continues to hold within thinning daily cloud (106.70/107.29), as the bear-leg from 11 May high at 107.76 was repeatedly rejected at cloud base and on course for the second daily Doji today, which signals indecision.

The larger downtrend from 111.71 (24 Mar high) remains intact, with daily techs still showing mixed signals that reflects on current price action, however, stronger bearish signals can be seen on weekly chart.

Bears need a break below cloud base (106.70) and Fibo support at 106.44 (50% retracement of 101.18/111.71) to signal continuation and expose next key support at 105.98 (7 May low, the lowest since 17 Mar).

Alternative scenario requires lift and close above cloud top to sideline downside risk, but more work at the upside (break of converged 30/55DMA’s at 107.45/55 and 11 May high at 107.76) would be needed to revive bulls.

Res: 107.10; 107.29; 107.55; 107.76

Sup: 106.70; 106.51; 106.22; 105.98