Near-term action remains biased lower, underpinned by solid UK GDP

Dip to one-week low (0.8431) after UK GDP beat was short-lived as pound reversed the largest part of post-data gains.

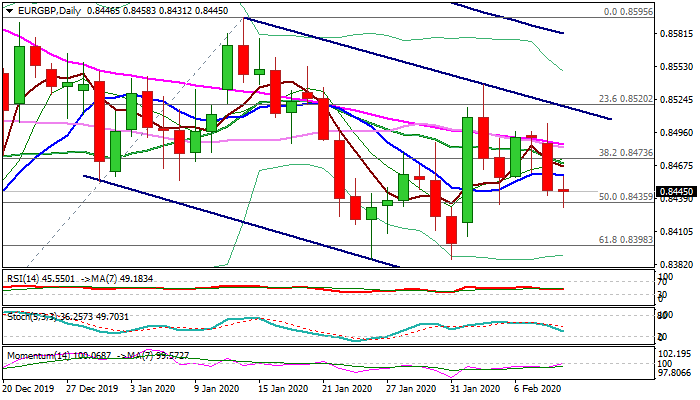

Monday’s long bearish daily candle weighs on near-term action but rising daily momentum so far offsets negative impact.

Other indicators (MA / stochastic / RSI) are in negative setup and threatening of limited recovery (so far capped by 10DMA at 0.8460) before bears regain full control.

Firm break of cracked Fibo support at 0.8435 (50% retracement of 0.8276/0.8595) would spark fresh weakness towards 0.8398 (Fibo 61.8%) and 0.8386 (lows of 31/24 Jan).

Conversely, close above 10DMA would ease negative pressure, but lift above 0.8466/86 zone (falling 20/30/55 DMA’s) would neutralize threats and shift near-term focus up.

Res: 0.8460; 0.8466; 0.8486; 0.8503

Sup: 0.8431; 0.8398; 0.8386; 0.8351