Near-term directionless mode extends

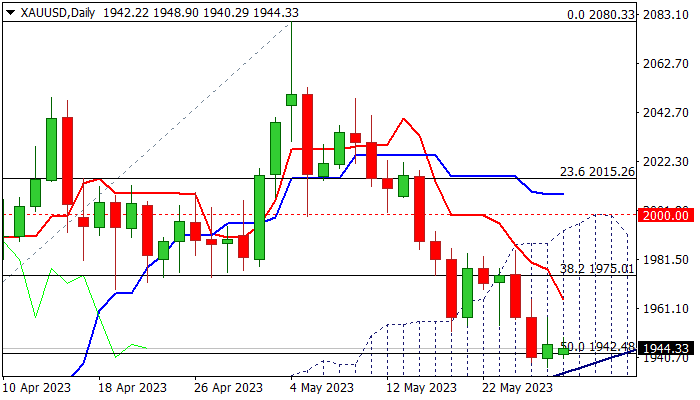

Gold is trading in a narrow-range sideways mode for the second straight day, hovering above new multi-week low and nearby trendline support ($1936).

Metal’s price is stuck between two opposite forces – optimism about eventual deal in debt ceiling deal (positive) and signs that the Fed may keep high interest rates for longer period (negative).

Prolonged indecision on mixed fundamentals suggests that traders look for fresh direction signals, as daily technical studies also show conflicting signals on overall bearish structure but oversold conditions.

Initial bullish signal to be expected on close above falling 10DMA ($1964) and signal verification to be seen on extension above $1975/93 (broken Fibo 38.2% of $1804/$2080 / daily cloud top).

On the other hand, larger bears would tighten grip after current consolidation if price break below trendline support / 100DMA ($1936) and signal confirmation expected on close below daily cloud base ($1926).

Res: 1964; 1975; 1985; 1993

Sup: 1936; 1926; 1918; 1909