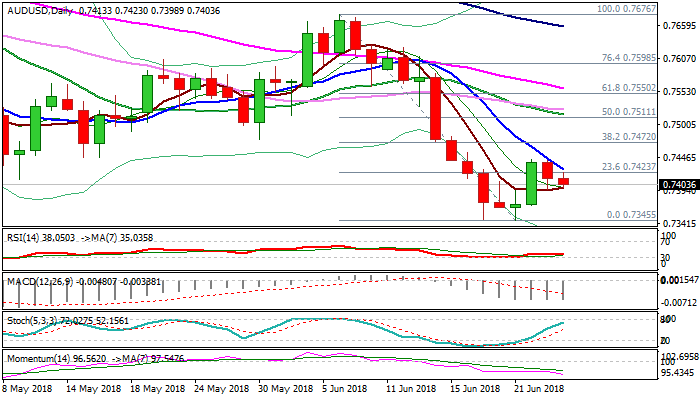

Near-term risk skewed lower while falling 10SMA caps

The Aussie dollar remains at the back foot on Tuesday and pressures lower pivots at 0.7399/94 (5SMA / base of thick hourly cloud) following Monday’s close in red after repeated upside failure which left a double-top.

Falling 10SMA capped the action and continues to pressure (currently at 0.7428) as daily studies show MA’s in bearish configuration and 14-d momentum heading south, deeply in negative territory.

Negative sentiment is helped by risk-off mode and close below 5SMA / hourly cloud base would be negative signal for possible extension towards key supports at 0.7345/25 (19/21 June base / Fibo 61.8% of larger 0.6825/0.8135 ascend).

Immediate downside risk could be sidelined on close above 10SMA, but break and close above 0.7472 (Fibo 38.2% of 0.7676/0.7345 bear-leg) is needed to confirm continuation of recovery from 0.7345 base.

Res: 0.7428; 0.7443; 0.7472; 0.7511

Sup: 0.7394; 0.7383; 0.7368; 0.7345