Oil edges higher on concerns about output disruption but key barriers are still intact

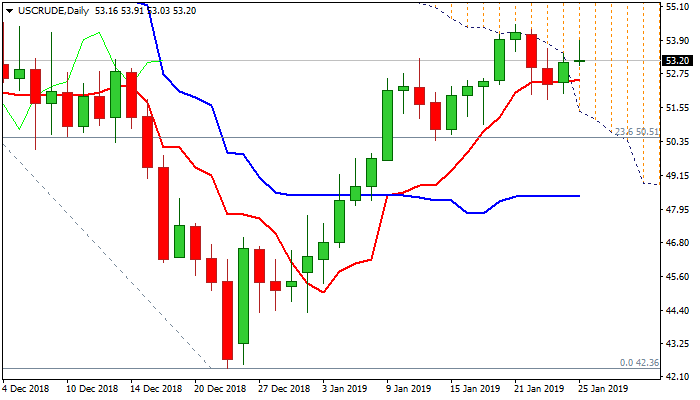

WTI oil ticked higher on Friday and eventually penetrated thick daily cloud after cloud base capped attempts in past few sessions.

Fresh boost for oil price came from political turmoil in Venezuela that raises concerns about potential output disruption.

Also, US crude stocks rose strongly in the previous week, adding to the upside pressure.

Thursday’s bullish engulfing was positive signal, however, daily techs are still mixed and provide no clear signal for now.

Close within cloud would keep bullish bias but signals of bullish continuation could be expected on break above pivots at $54.48 (2019 high posted on 21 Jan) and $55.55 (Fibo 38.2% of $76.88/$42.36).

Broken 55SMA / cloud base ($51.52/14) provide solid supports which are expected to contain deeper corrective dips.

Res: 53.91; 54.48; 55.00; 55.55

Sup: 53.03; 52.55; 51.52; 51.14