Oil falls further as sentiment weakens on rising concerns about demand growth

WTI oil fell $1 on Tuesday, extending strong losses from the previous day, as weak China’s data on Monday soured sentiment and added to worries about demand growth of top oil importer.

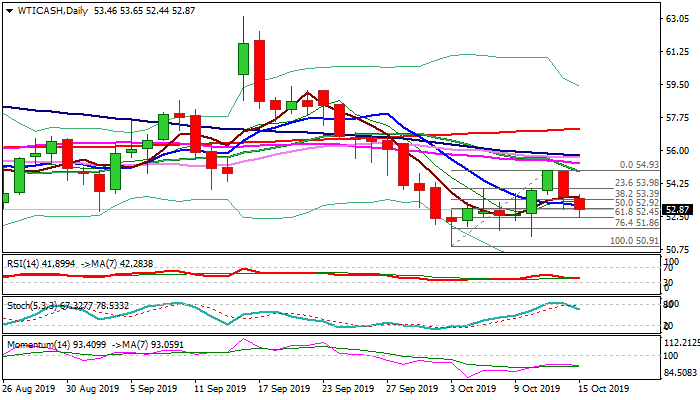

Better than inflation data from China today, failed to improve the outlook as oil price dipped to $52.44 (Fibo 61.8% of $50.91/$54.93 / base of 4-hr cloud) with risk of further weakness expected on firm break here.

Rising bearish sentiment on daily chart and south-heading Stochastic / RSI, as well as MA’s in bearish setup, add to negative outlook.

Loss of $52.44 handle would expose $51.40 (10 Oct low) and risk extension towards key near-term level at $50.91 (3 Oct spike low).

Session high at $53.65 reinforced by 5DMA) marks initial barrier and should keep the upside protected and guard key resistance at $54.93 (11/14 Oct highs, reinforced by falling 20DMA).

Res: 56.00; 53.65; 53.98; 54.93

Sup: 52.44; 52.00; 51.86; 51.40