Oil hits new low as demand fears offset positive impact from supply cuts

WTI oil price pared brief overnight’s gains and fell to new two-week low at $21.66 in European trading on Tuesday, extending weakness into third straight day.

Sentiment remains weak as traders strongly fear significant drop in global demand due to coronavirus lockdown, with no positive impact from decision of OPEC+ group to reduce output and signals that production of US shale oil would fall by record amount in April.

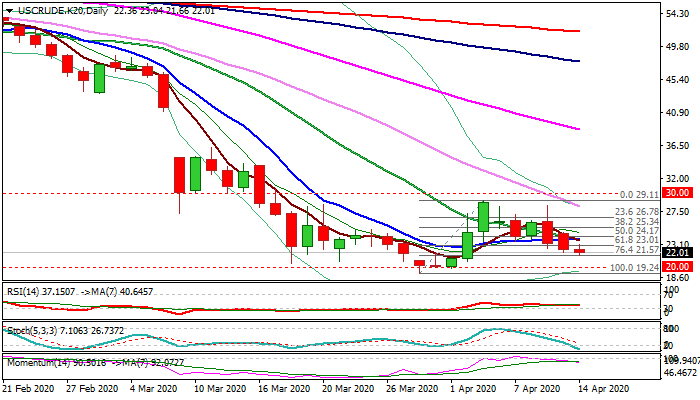

Technical outlook is also negative, as daily studies maintain strong bearish momentum and moving averages are in full bearish configuration, with additional negative signal being generated on Monday’s close below $23.01 (Fibo 61.8% of $19.24/$29.11 recovery leg).

Bears came ticks ahead of next Fibo support at $21.57 (76.4%) with break here to further weaken near-term structure and risk retest of key $20 support zone.

Traders focus two crude inventories reports (API report is due late today and EIA on Wednesday) with fears that crude stocks would rise further and increase pressure on oil prices.

Res: 23.01; 23.89; 24.17; 24.66

Sup: 21.57; 20.74; 20.00; 19.24