Oil is consolidating after strong fall on Thursday, near-term bias remains with bears

Oil price regained traction and edged higher on Friday morning, after falling over 3% previous day, following comments from Russian member of OPEC+ that the cartel is unlikely to further cut production at their meeting on June 4.

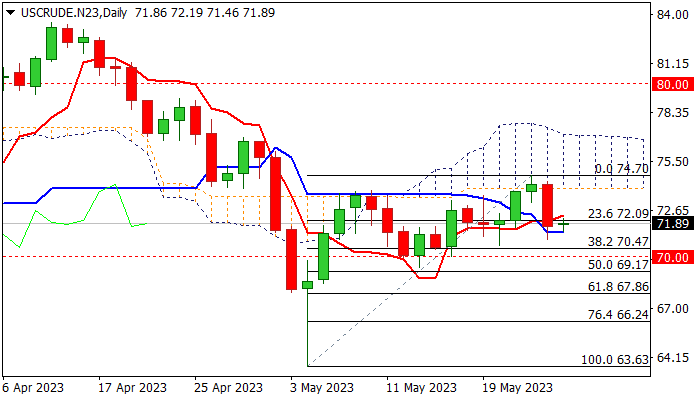

Thursday’s strong fall (the biggest daily loss since May 3) confirmed a double rejection at the base of thick daily cloud and generated bearish signal on completion of reversal pattern on daily chart, though the signal is still to be justified on break of $70.65/47 pivots (May 22 spike low / Fibo 38.2% of $63.63/$74.70 upleg).

Daily studies are turning to full bearish mode as falling 14-d momentum broke into negative territory, moving averages are in bearish setup and thick daily cloud weighs, suggesting that bears may re-take control after limited consolidation (to be capped under 5DMA at $72.75).

Weekly studies are also bearishly aligned, though the action of this week is on track to end in the shape of Doji candle, which signals indecision and seeks for fresh direction signal.

Res: 72.09; 72.75; 73.27; 73.93

Sup: 71.39; 70.98; 70.42; 70.00