Oil is on track for the sixth consecutive weekly gain, inflated by vaccine optimism and rising demand

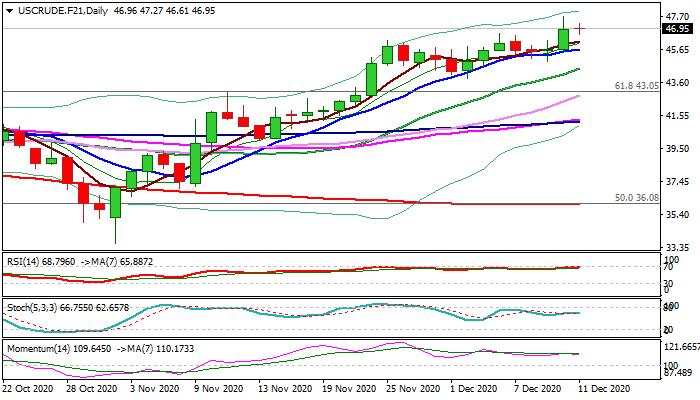

WTI oil is holding positive tone and probing above $47 handle in early Friday, following Thursday’s 2.7% advance that hit new post-pandemic recovery high at $47.71 (the highest since early March).

The oil is on track for a sixth straight week of gains, driven by improved risk sentiment on rollout of coronavirus vaccination that boosts hopes or stronger rebound in fuel demand.

Encouraging signals from rising demand in Asia so far compensate negative impacts from unexpected strong rise in US crude stocks and impending lockdowns across the US and Europe, keeping oil prices inflated.

Technical studies on daily and weekly charts are in bullish setup and supportive for further advance, although overbought weeklies warn that bulls may take a breather before attacking targets at $48.47 (100WMA) and psychological $50 barrier.

Dip-buying remains favored, with rising 10DMA ($45.68) marking initial support, ahead of Wednesday’s low ($44.94), rising 20DMA ($44.48) and Dec 2 trough ($43.87) which should contain extended dips and keep bulls intact.

Res: 47.27; 47.71; 48.47; 49.00

Sup: 46.65; 46.00; 45.68; 44.94