Oil price eases on new virus cases but so far holding above $40 pivot

WTI oil near $40 support in early Monday (down 1.3% for the session) as rising number of coronavirus globally sours the sentiment.

Cautious optimism over ongoing talks about EU recovery fund, aiming to revive pandemic-affected bloc’s economies, keeps dips limited for now.

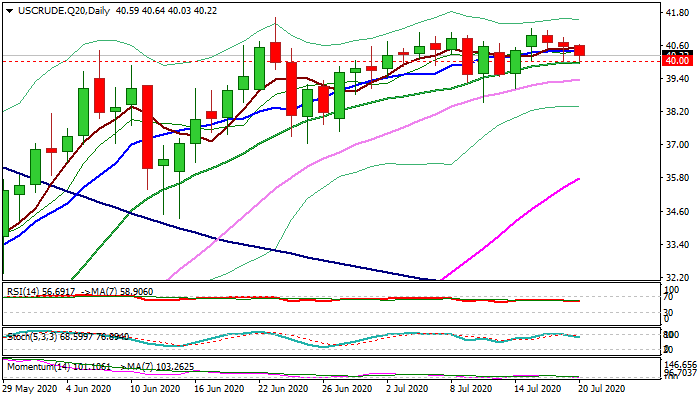

Technical studies show risk of pullback (after larger recovery from historic lows repeatedly failed to clearly break $40 barrier) as daily stochastic reversed from overbought territory and momentum approaches the border of negative zone, while double weekly Doji signals indecision and bearish divergence on weekly stochastic / momentum adds to negative signals.

Psychological $40 support is reinforced by 20DMA and break lower would expose lower pivots at $39.37 (55DMA) and $38.38 (lower 20-d Bollinger band) violation of which would generate stronger bearish signal,.

Ability to hold above $40 level would keep slight bullish bias, but stronger bullish signals could be expected on filling March’s gap ($41.59/$33.00).

Res: 40.87; 41.23; 41.59; 42.00

Sup: 40.00; 39.37; 39.05; 38.38