EURGBP falls to one-week low

EURGBP

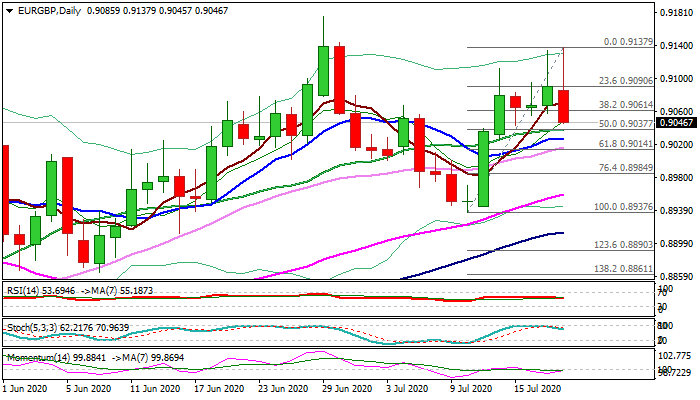

The cross fell sharply on Monday (down 0.8% for the session) as sterling rallied across the board, being the top winner of European session.

Monday’s action repeated strong upside rejection from Friday, forming the second daily candle with very long upper shadow.

Double failure to sustain break above trendline resistance (0.9107) and subsequent acceleration lower, warns of bull-trap above the bear-trendline that increases risk of reversal.

Fresh weakness probes below pivotal Fibo support at 0.9061 (38.2% of 0.8937/0.9137 upleg), with today’s close below this level to add to negative signals.

Daily MA’s are in bullish setup, but south-heading stochastic and RSI and flat momentum, point to mixed technical signals and unclear near-term direction.

Possible scenarios include clear break of 0.9061 pivot that would soften near-term structure and risk extension towards 0.9037/17 zone (converged 20/10/30DMA’s) or repeated failure to clear 0.9061 support that would keep the pair in extended congestion as long upper shadows of recent daily candles suggest that the upside is protected for now.

Res: 0.9061; 0.9084; 0.9100; 0.9137

Sup: 0.9037; 0.9017; 0.9000; 0.8984