Oil price falls below $100 on Ukraine talks, concerns over China demand

WTI oil price fell below $100 per barrel on Tuesday morning, for the first time since March 1, deflated by hopes that ceasefire talks would ease risks of further supply disruptions, while surging Covid cases in China adds to concerns about slower demand from the world’s biggest oil importer.

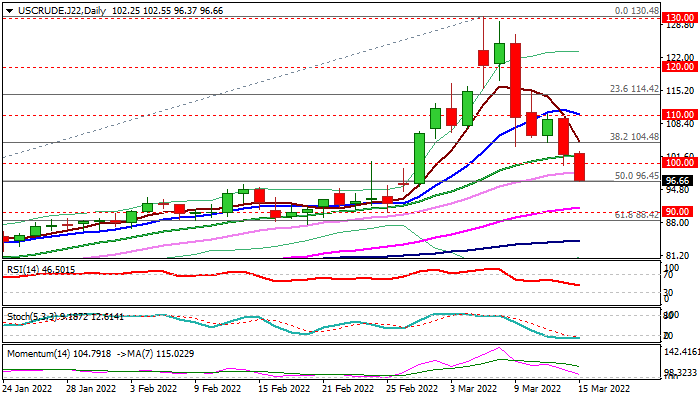

Pullback from new multi-year high at $130.48, extends into second week, as Monday’s 6.8% drop was followed by 5.6% in Asian / early European trading on Tuesday, signaling that bears are gaining pace in current favorable conditions.

Break of $100 level tested $96.45 (50% retracement of $62.42/$130.48 upleg) and could extend towards rising 55DMA ($90.97) and round-figure support at $90, which guard key supports at $88.42 (Fibo 61.8%) and $87.28 (top of rising daily cloud.

Sharp loss of positive momentum adds to weakening daily studies, with close below $ 100 to further weaken near-term structure.

Broken $100 level offers solid resistance, with extended upticks to stay below 20DMA ($101.77) and keep bears in play.

Res: 98.26; 100.00; 101.77; 104.48

Sup: 96.45; 94.42; 90.97; 90.00