Oil price regains traction on tight supply and continuing demand recovery

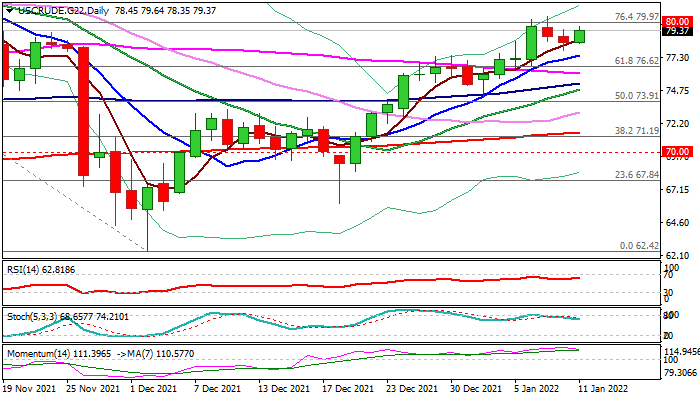

WTI oil rises on Tuesday, signaling that pullback after repeated failure at psychological $80 barrier was shallow and short-lived (contained by rising 5DMA).

The overall sentiment remains positive on tight global supply and expectations that rising number of new coronavirus cases will not have strong impact on global demand recovery.

Soaring number of new infections so far did not result in severe restrictive measures, while OPEC supply additions are still below their allowed increase due to a cartel’s agreement that supports oil prices.

Psychological $80 barrier (also Fibo 76.4% of $85.39/$62.42 fall) is under pressure again, with sustained break higher to confirm that larger corrective pullback ($85.39/$62.42) is over.

However, caution is still required as bulls may face strong headwinds at $80 zone again, as bullish momentum on daily chart is weakening and stochastic continues to diverge from the price action.

Crude inventories reports (API due late today and EIA on Wednesday) would provide fresh signals.

Res: 80.00; 80.44; 81.31; 81.77

Sup: 78.35; 77.82; 77.48; 76.62