Oil price rises on improved sentiment but faces strong headwinds at key resistance zone

Oil price rose on Tuesday on optimism on eventual deal on debt ceiling talks to avoid debt default scenario, while the latest comments from Saudi oil minister fueled expectations that OPEC+ may opt for further production cuts in its June 4 meeting.

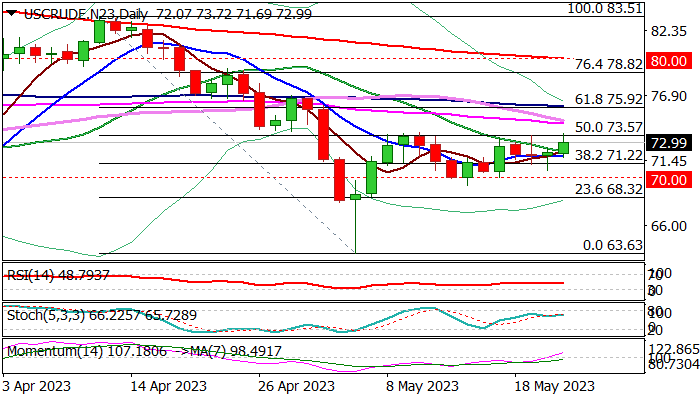

WTI contract price was up around 1.6% until early US session on Tuesday and trading at the ceiling of recent four-day congestion, but facing strong barriers in this zone, marked by 50% retracement of $83.51/$63.63 fall ($73.57) and the base of thick daily cloud ($73.93).

Immediate break higher is unlikely, despite improving daily studies, as the action faced several rejection at these levels in past two weeks and shaped the lower platform on daily chart, reinforced by thick daily cloud base.

Repeated failure would keep the price in prolonged range-trading, but biased higher while holding above 10DMA ($71.77).

Fresh signals will be expected from crude inventories reports today (API) and on Wednesday (EIA), as well as from the developments in debt talks, as the deadline nears.

Res: 73.57; 73.93; 74.53; 75.92

Sup: 72.25; 71.77; 71.22; 70.65