Weak UK PMI data deflate pound but key supports still hold

Cable accelerated lower on Tuesday, deflated by weaker than expected UK PMI data for April.

Activity in services sector, the largest segment of UK economy, fell to 55.1 from 55.9 previous month and missed consensus at 55.5, while manufacturing PMI fell to 46.9 in April from 47.8 in March and strongly undershot 48.0 forecast.

Growth in services sector kept momentum despite weaker numbers in April, while business in manufacturing contracted again and continued to diverge from services.

Higher prices in services sector, due to stubbornly high inflation slowed the activity despite strong demand, which adds to BoE’s worries that inflationary pressures may not ease at desired pace.

Markets shift focus to the UK inflation report on Wednesday, with expectations that CPI will drop to 8.3% in April from 10.1% previous month.

Pound will come under fresh pressure if inflation meets expectations, or possibly ease further, while higher than expected Apr figures would add pressure on BoE and boost prospects for further rate hikes.

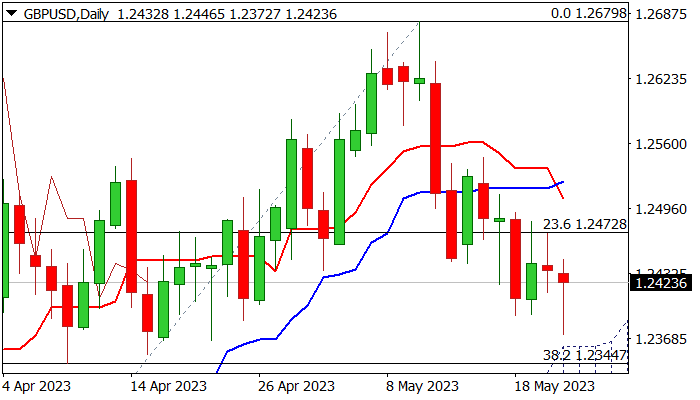

Weakening daily studies (multiple 10/20/30 MA’s bear-crosses, rising bearish momentum) contribute to negative signals, as the price approaches key supports at 1.2361/44 (daily cloud top / Fibo 38.2% of 1.1802/1.2679).

Increased headwinds can be expected at this zone and possibly to slow bears for consolidation, however, near-term bias is expected to remain negative as long as price action is capped by broken Fibo 23.6% / falling 10 DMA (1.2472/76).

Res: 1.2472; 1.2490; 1.2514; 1.2546

Sup: 1.2361; 1.2344; 1.2274; 1.2241