Oil prices drop on unexpectedly strong build in weekly crude inventories

WTI oil fell over $1 after EIA report showed US weekly crude inventories rose by 15.2 million barrels in the week to Dec 9, marking the biggest weekly build in nearly eight months.

Downbeat data increased pressure on oil prices, reviving concerns about fresh slowdown in global demand recovery and fading the positive sentiment on Covid-19 vaccine that kept oil prices afloat.

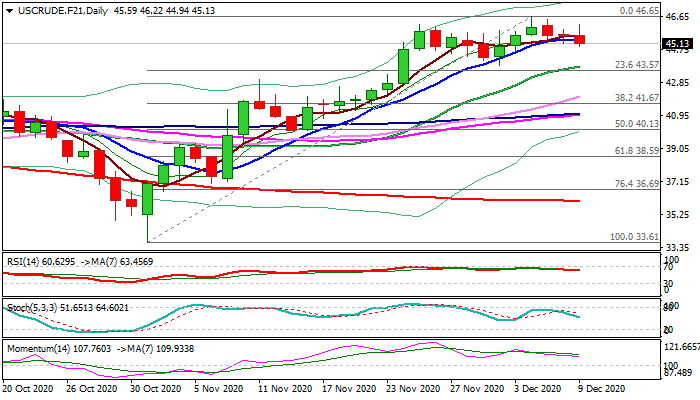

Strong increase in crude stocks against expected drop of 1.4 million barrels and previous week’s 0.6 million barrels draw, could sour the sentiment and risk deeper drop from new recovery peak at $46.65 (the highest since early March).

Fresh bears cracked initial support at $45.28, provided by 10DMA, which tracks the advance since Nov 9, with daily close below 10DMA to generate initial negative signal and open way for possible extension towards key near-term supports at $43.87/81 (Dec 2 low / rising 20DMA).

Bearish divergence on south-heading momentum and stochastic indicators on daily chart, reinforces negative signals.

Res: 45.34; 45.57; 46.22; 46.65

Sup: 44.64; 44.00; 43.87; 43.57