Oil prices remain supported by global supply concerns

WTI oil is consolidating near new two-week high after Thursday’s 3.3% advance and maintaining firm tone, amid concerns about global supply.

Talks about EU ban on Russian oil, although so far without consensus as Hungary opposes the decision and expectations for increased demand on upcoming US summer driving season, continue to support oil prices.

In addition, the OPEC+ group will stick to its oil production deal, reached last year and raise July output targets by 432,000 barrels per day, despite call from the Western countries for higher output increase that would further underpin oil prices.

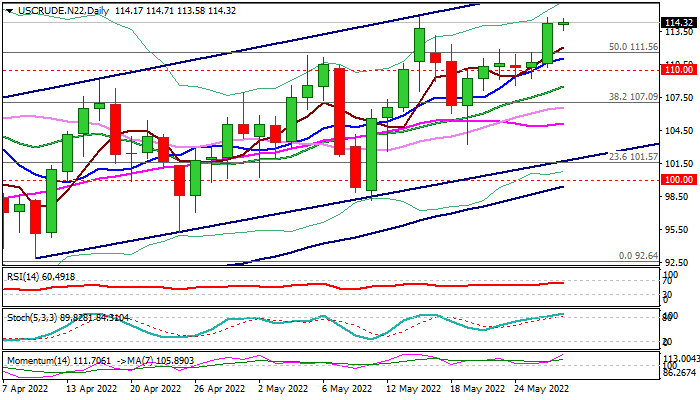

The WTI contract is on track for strong weekly gains and for a fourth consecutive weekly close above $110 level, with daily studies in full bullish setup and supportive for further advance, as the action is also supported by thickening daily Ichimoku cloud.

Bulls pressure May 16 high at 114.87, violation of which would expose pivotal barriers at 116.03 and 117.40 (Fibo 61.8% of $130.48/$92.64 / upper bull-channel boundary).

Broken 50% retracement level at 111.56 marks solid support which is required to hold and keep bulls intact.

Lower pivots lay at 110.00/108.96 (psychological / daily cloud top) and break here would weaken near-term structure.

Res: 114.87; 116.03; 116.60; 117.40;

Sup: 113.16; 111.56; 110.00; 108.96