Oil stands at the back foot and looks for fresh signals from crude inventories report

WTI oil is holding within tight consolidation in early Thursday’s trading after strong two-day fall. Oil prices came under pressure on increasing turbulence in emerging markets and concerns about the trade conflict between the US and China, but stronger negative impact was offset by supply concerns over sanctions on Iran and unexpected draw in US crude stocks (API report showed 1.2 million barrels draw vs previous week’s build of 0.03 million barrels.

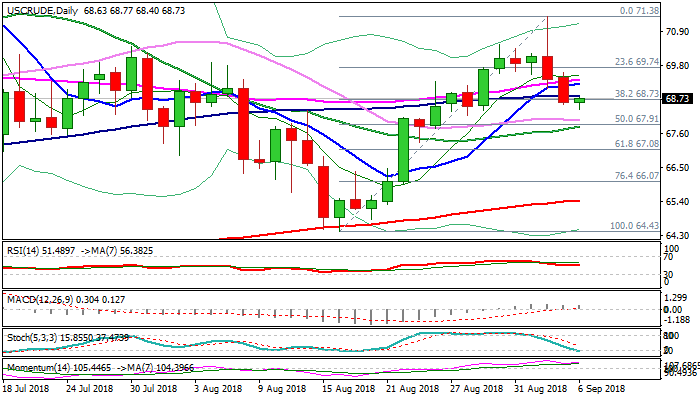

Wednesday’s break and below a cluster of daily MA’s (55/10/100) between $69.35 and $68.83, as well as close below $68.73 (Fibo 38.2% of $64.43/$71.38 upleg) was bearish signal, which requires confirmation on repeated close below.

However, overall picture remains bullish and current pullback could be seen as corrective action if the price fails to clearly break below $68.73 Fibo support.

Release of EIA crude inventories report, due later today, is eyed for fresh signal. Draw of 1.29 million barrels is forecasted, compared to previous week’s fall of 2.55 million barrels.

Stronger than expected drop in crude stocks would offer fresh support to oil prices and signal reversal, while negative scenario could risk extension towards next support area between $68.04 and $67.85 (converging 30/20SMA’s).

Res: 68.83; 69.35; 69.74; 70.00

Sup: 68.40; 68.04; 67.85; 67.08