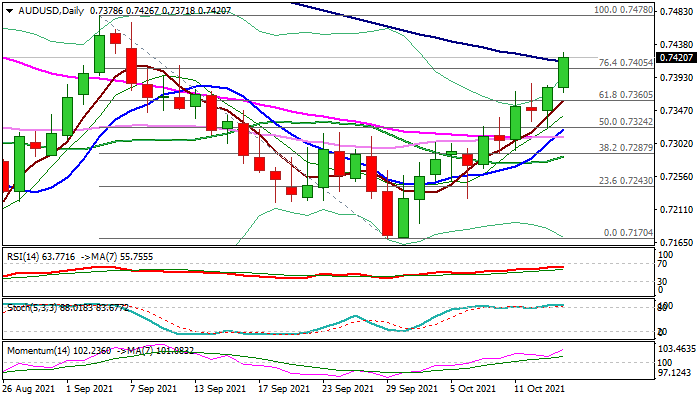

Post-FOMC acceleration signals that uptrend could extend further

The Australian dollar holds in steep ascend for the second consecutive week and accelerated to five-week high on Thursday after FOMC minutes deflated the US dollar.

Bulls broke above 0.7405/14 (Fibo 76.4% of 0.7478/0.7170 / falling 100DMA) and pressure pivotal barrier at 0.7450 (Fibo 38.2% of 0.8007/0.7106) the last obstacle on the way towards key resistance at 0.7478 (Sep 3 lower top).

Break here would complete a failure swing pattern on weekly chart and signal reversal of larger downtrend from 0.8007 (2021 high, posted on Feb 25).

Daily studies show strong bullish momentum which has a space to rise more and multiple bull-crosses of daily MA’s that support bullish outlook.

Dips are expected to stay above broken Fibo 61.8% barrier (0.7360) to provide better opportunities to re-join an uptrend.

Res: 0.7426; 0.7450; 0.7478; 0.7502

Sup: 0.7400; 0.7372; 0.7360; 0.7324