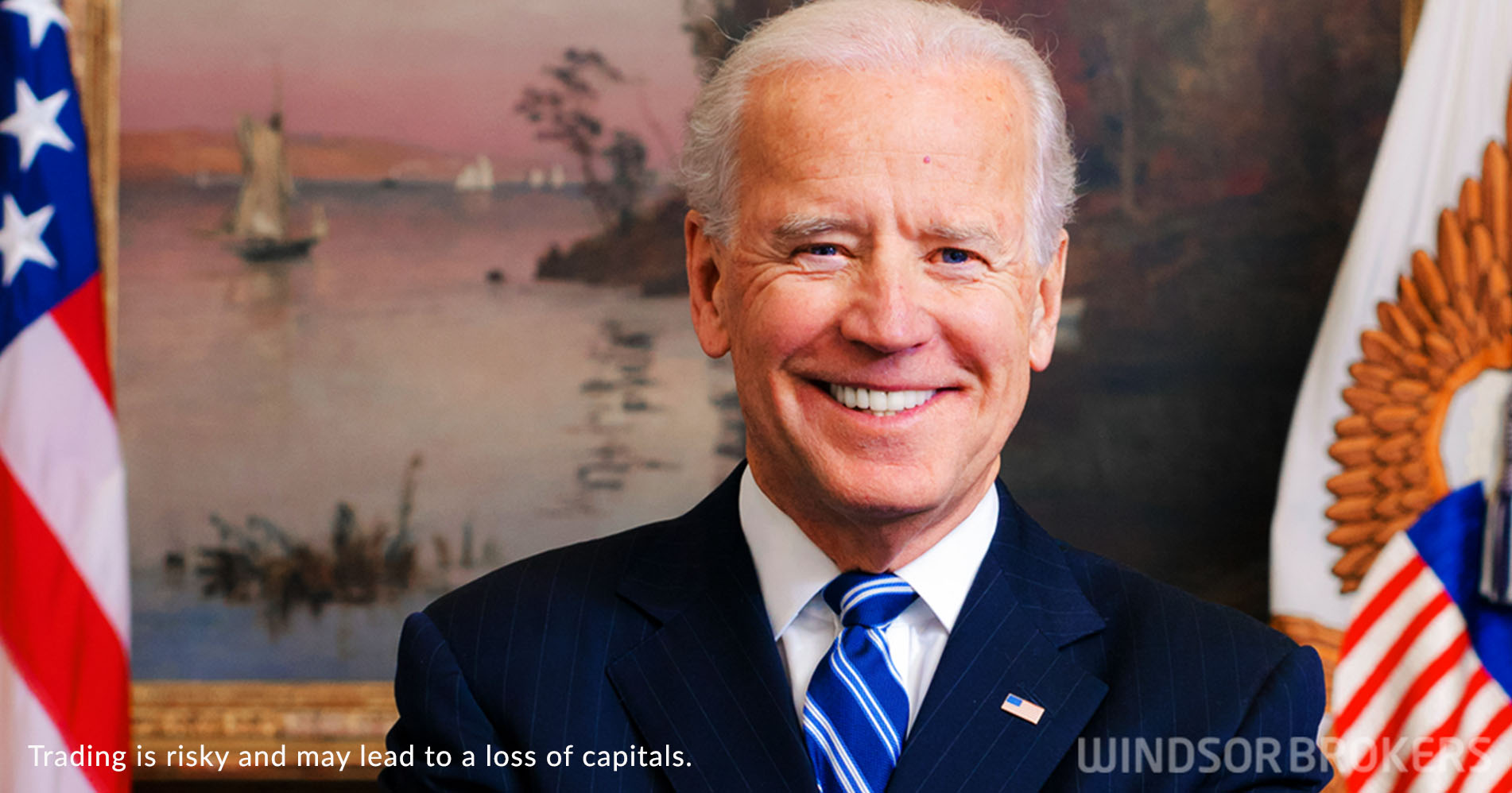

President Biden’s historic tax increase plan for the rich to be released soon

The US President Joe Biden is expected to release his plan to increase taxes on the wealthiest Americans, as a plan of the US tax system overhaul aims to make rich companies and individuals pay more to fund a childcare, education and paid leave for workers and boost Biden’s ambitious economic agenda.

The proposal which calls for increasing the top marginal income tax to 39.6% from 37% and to nearly double taxes on capital gains for people gaining more than $1 million, would be the highest tax rate on investment gains since 1920’s as the rate has never exceeded 33.8% since the end od the Word War Two.

Biden has also promised not to raise taxes on households earning less than $400.000.

The plan first needs to go through the Congress, where Democrats hold narrow majority, while Republicans are likely to vote against, ahead of the Senate where each party holds 50 seats.

The details of the plan are expected to be released before Biden’s address to Congress next week and some parts may change before the release as White House officials are debating over other possible tax increases, such as increasing the estate tax.

Biden is determined to make the wealthiest Americans and companies to pay and fund his economic plan and believe that new measures would not have a negative impact on investments in the United States.