Probe through key barriers signals further gains

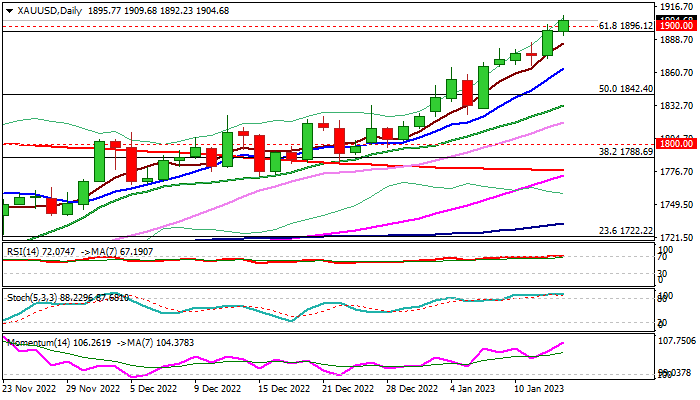

Gold keeps firm bullish stance and probing through key barriers ay $1896/$1900 (Fibo 61.8% of $2070/$1614 / psychological) on Friday.

The metal is on track for the third straight strong weekly advance, underpinned by weaker dollar on signals that easing US inflation would slow the pace of Fed’s rate hikes.

Firm bullish structure on daily chart signals further gains, though bulls may face difficulties to clearly break pivots at $1896/$1900, as studies are overbought on both, daily and weekly chart.

Potential dips are expected to offer better prices for re-entering bullish market, with broken weekly cloud top ($1875) and rising 10DMA ($1864) offering strong support, which should keep the downside protected.

Sustained break of $1896/$1900 zone would generate strong bullish signal and open way for acceleration towards next target at $1962 (Fibo 76.4%).

Res: 1909; 1935; 1962; 1981

Sup: 1885; 1875; 1864; 1842